| Program Outline Bachelor of Commerce (Hons) B.Com (Hons) - Integrated with ACCA | |

| Duration | 4 Years |

| Affiliation | PES University |

| Campus | PES University Ring Road Campus |

| Degree Offered | B.Com (Hons) in International Finance and Accounting |

| Admissions Test | PES Entrance Test |

B.Com (Hons) from PES University is a four-year Bachelor’s degree integrated with the curriculum for the ACCA Professional Qualification. Notably, this program does not have an exit option. This comprehensive global bachelor’s programme is exquisitely crafted to strengthen global careers, establish exceptional knowledge, and bridge the talent gap in the fields of commerce and finance. The programme allows students to pursue global careers in various technical areas, including audit and assurance, corporate reporting, financial management, tax, governance, and ethics. 9 paper Exemption – PES University is the first in India to get this in launch year.

Why ACCA ?

Here are just some of the reasons why you should choose ACCA as your route to becoming a qualified accountant:

The ACCA Qualification is the world’s most widely recognised accountancy qualification for aspiring financial professionals.

ACCA’s mission is to provide business-relevant, first-choice qualifications to people with the aptitude, talent, and ambition to pursue a fulfilling career in accountancy, finance, or management anywhere in the world.

As a chartered accountants’ community, ACCA has over 2,52,500 members and 5,26,000 students at various stages of their careers, served by a network of 180 offices and active centres. The ACCA qualification is recognised and highly respected, especially in the fields of investment banking, management, and consulting.

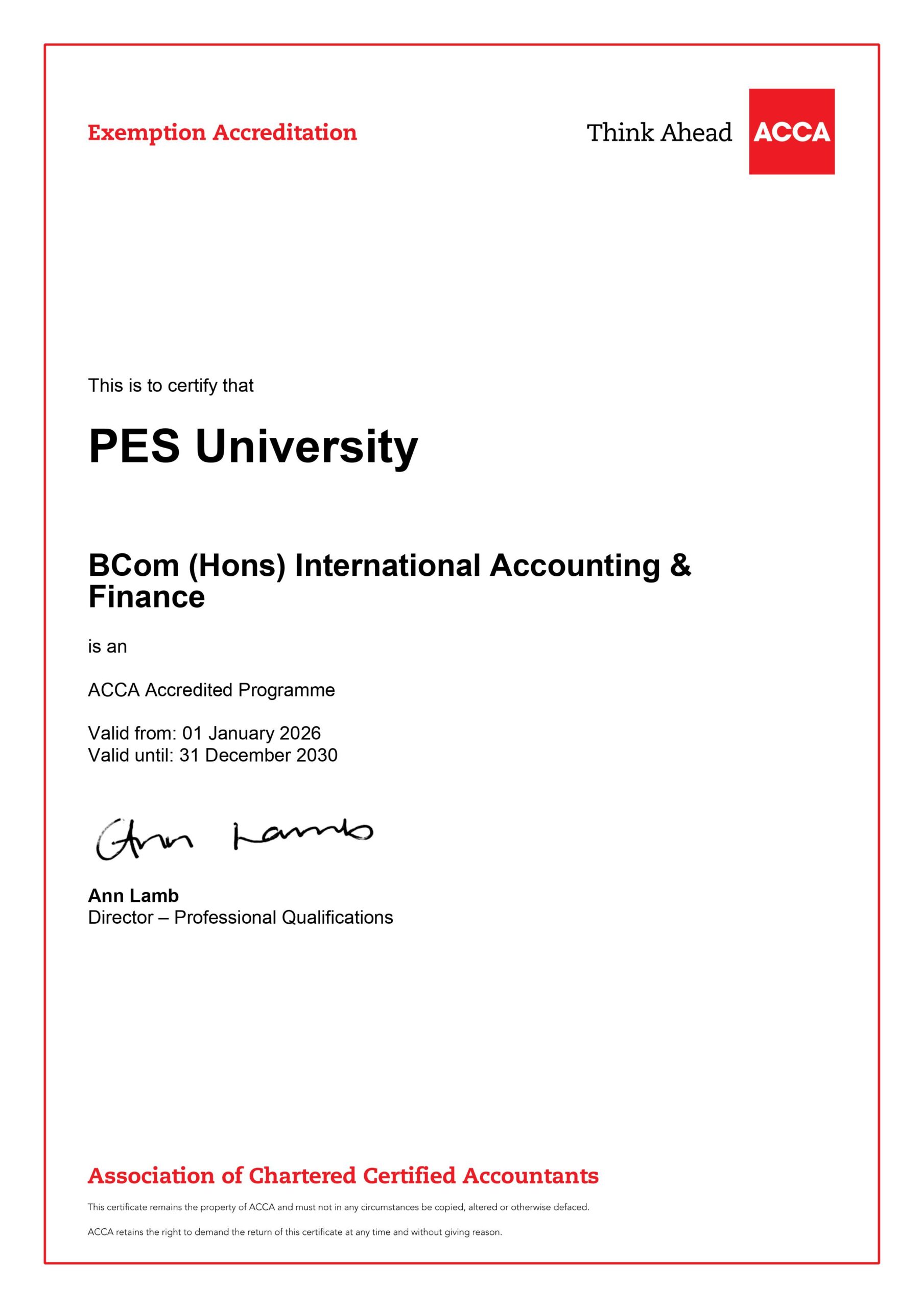

ACCA Accredited Program

Program Highlights

The B Com (Hons) with ACCA is a semester pattern based elite program. It offers the following attributes:

- 100% ACCA Subject Integration with the program

- Globally recognized accounting curriculum

- Complete handholding for all 13 subjects

- Pre examination Test Series for better results

- Experiential Learning for building competencies

- 9 ACCA Subject Exemption out of 13 subjects

- Paves way for Global CA recognition

- Additional Coaching for non-exempted papers

- 10 Year ACCA Registration Validity

- No additional ACCA tutoring charges shall be levied

- Internship Programs

- The most experienced Faculty Members

Curriculum Structure

The B.Com (Hons) in International Accounting & Finance (ACCA Accredited) at PES University is a comprehensive program designed to integrate the ACCA qualification within the degree itself. It provides students with a strong foundation in accounting, finance, and related subjects while preparing them for global career opportunities.

- 100% ACCA-Embedded Syllabus:

- The curriculum is fully aligned with the ACCA’s syllabus, covering all necessary subjects and skills required to qualify as a professional accountant.

- Subject Exemptions:

- Year 1 and Year 2: Students receive exemptions for 9 ACCA papers in the first two years. PES University is the first in India to achieve this milestone.

- From 2nd Year Onwards: Students begin focusing on non-exempted ACCA papers to complete the professional qualification.

- Certifications and Recognition:

- The qualification is internationally recognized and accepted in over 180 countries.

- Career Prospects:

- This program opens up global career opportunities, particularly in the Big 4 firms and fields like investment banking, management, and consulting.

- Key Subjects:

- Exempted Papers:

- Financial Reporting

- Business & Corporate Law

- Management Accounting

- Audit & Assurance

- Financial Management

- Business & Technology

- Performance Management

- Advanced Business Accounting

- Non-Exempted Papers:Any two of the following 4

- Advanced Financial Management

- Advanced Performance Management

- Advanced Taxation

- Advanced Audit and Assurance

- Mandatory 2 papers – Non exempted

- Strategic Business Reporting

- Strategic Business Leader

- Exempted Papers:

Curriculum Structure

Semester 1

| Course Title |

| Business and Technology- ACCA |

| Business and Corporate Law- ACCA |

| Financial Accounting - ACCA |

| Data Analysis and Interpretation |

| Advanced Excel |

| Constitution of India |

Semester 2

| Course Title |

| Geopolitics |

| Advanced Corporate and Business Law |

| Advanced Financial Accounting |

| Management Accounting-1 |

| Direct tax |

| EVS |

Semester 3

| Course Title |

| Fundamentals of Financial Reporting |

| Fundamentals of Financial Management |

| Management Accounting-2 |

| Audit and Assurance |

| Computer Applications in Business |

| Social Internship |

Semester 4

| Course Title |

| Financial Reporting |

| Financial Management |

| Strategic Business Leader-1 |

| Strategic Business Reporting-1 |

| Fundamentals of Performance Management |

| Python |

Semester 5

| Course Title |

| Strategic Business Leader-2 |

| Strategic Business Reporting-2 |

| Performance Management |

| Advanced Performance Management -I /Advanced Audit Assurance -1/Advanced Financial Management -1 (any 1) |

| Tableau |

Semester 6

| Course Title |

| Internship |

Semester 7

| Course Title |

| UK Taxation |

| Advanced Performance Management -II /Advanced Audit Assurance -1I/Advanced Financial Management -I1 (any 1) |

| GST Compliance and Customs |

| Capstone Project |

| Power BI |

Semester 8

| Course Title |

| Internship |

*Subject to change (Total Credits = 160)

Program Delivery

The ACCA assessments are conducted at three stages, further sharpening the students’ vision towards their goal in the following phases:

- Knowledge Level: The 3 papers at this level have been completely exempted. Students must clear the subjects while pursuing the B.Com. (Hons) with ACCA program to claim this exemption.

- Skills Level: The 6 papers at this level have also been completely exempted. Students preparing to appear for the computer-based test will undergo comprehensive study along with dedicated additional hours of training to clear the ACCA professional papers on their first attempt, as all these papers are interlinked with the professional level subjects.

- Professional Level: This stage consists of essential and optional modules. Students appearing for these exams will undertake written exams, which are scheduled in January, March, September, and December at any ACCA venue.

- Proficiency for Graduates: At PES University, Commerce graduates are trained to become industry-ready, equipped to take on diversified job profiles ranging from Accounting and Costing to Taxation, Banking, Finance, Insurance, Research, and Global Professional roles. The B.Com. (Hons) with ACCA aspirants, as future graduates, are expected to stay updated with global developments, achieving proficiency and training in advanced principles of International Accounting and Finance. The wide scope of opportunities invites ACCA professionals to engage in crucial domains of business decision-making and corporate compliance.

Pedagogy

- Interactive Lectures

- Case Studies

- Guest Lectures and Industry Insights

- Workshops and Seminars

- Professional Certification Support

- Internships and Practical Experience

- Technology Integration

- Research Projects

- Continuous Assessment

Skill Based Certification Courses

Emphasis on leading the students towards a fundamentally strong and professionally driven careers through the implementation of additional certification programmes as following:

- Advanced Excel

- Commodity Markets

- Financial Modelling

- Export & Import Documentation

- Aptitude Skill Development

- Actuarial Science

- Python

Exposure

- CFO Lounge

- Commerce Conversation Series

- Hackathons

- Studyathons

- Readathon

- Workshops

- Forum activities

- Industry Visits

- NGO drive

Industry-Academia Tie-ups

Nature of Collaboration

- Live problems for Hackathons

- Consultancy

- Projects

- Training

- Summits/Workshops

- Invited Lectures

- Minors/Specialisation

Career options

Commerce graduates from PES University are trained in such a way that they are industry ready to perform variety of jobs such as Tax Consultants, Wealth Managers, Risk and Security Analysts, Market Analyst, Banking and Insurance, Researcher and Policy Maker.

The graduating students would be equipped with knowledge, tools, methods, theories, and practices of Commerce profession and trained to apply them in day-to-day life industry and other walks of life to optimize the outcomes. The Commerce graduates may opt for the following career opportunities in various fields.

Research & Consultancy

- Research Associate

- Research Analyst

- Management Consultant

- Market & Policy Research Analyst

- Tax Consultant

- Business Analyst

- Business Analytics Specialist

Accounting Roles

- Professional Accountant

- Assistant Accountant

- Accounts Assistant

- Accounts Payable/ Receivable Specialist

- Management Accountant

- Financial Accountant

- Bookkeeper

- Trainee Accountant

- Fund Accountant

Audit & Assurance

- External Auditor

- Internal Auditor

- Forensic Accountant

- Risk Analyst

- Compliance Officer

Banking Sector

- Finance Manager

- Finance Business Partner

- Financial Controller

- Head of Finance

- Finance Director

- Assistant Management Accountant

Financial Planning & Analysis (FP&A)

- Financial Analyst

- Financial Planning and Analysis (FP&A) Specialist

- Budget Analyst

- Treasury Manager

- Wealth Manager

Banking & Investment

- Investment Banker

- Securities Analyst

- Loan Officer

- Financial Examiner

Placement Opportunities & Career Assistance

Placements have always been the USP of PES University. Professional placement assistance will be provided through the centralised placement cell of the university, along with organised training in soft skills, aptitude, etiquette, resume building, etc., from the first semester itself to instill the necessary qualities for students to succeed in campus placements.

IN ADDITION, THE FOLLOWING WILL BE EXTENDED TO ALL OUR B.COM (HONS) WITH ACCA STUDENTS:

RESUME BUILDING AND INTERVIEW WORKSHOPS: Career assistance includes workshops on resume building, interview skills, and effective communication, preparing students for the competitive job market.

MOCK INTERVIEWS: The university conducts mock interview sessions to help students gain confidence and polish their interview techniques. Feedback from industry experts is provided to help students refine their skills.

LEVERAGE OF OUR ALUMNI NETWORK: Graduates benefit from a strong and active alumni network that provides mentorship, networking opportunities, and insights into various career paths. Alumni often play a pivotal role in connecting current students with employment opportunities.

ACCA EXAM SUPPORT: Recognising the significance of the ACCA qualification, the university offers dedicated support for ACCA exam preparation, including study materials, practice exams, and guidance from experienced faculty.

INTERNSHIP OPPORTUNITIES: The university facilitates internships with leading organisations, allowing students to gain practical experience, apply classroom knowledge, and establish connections within the industry.

CAREER COUNSELING: The university offers personalised career counselling services to help students identify their strengths, interests, and career goals. This guidance assists students in making informed decisions about their professional journeys

Recruiters

Placements

Opportunities in the corporate sector are made available for outgoing students during their final semester for which professional training is imparted. Students are expected to have good academic records to ensure a definite placement

Placements

Opportunities in the corporate sector are made available for outgoing students during their final semester for which professional training is imparted. Students are expected to have good academic records to ensure a definite placement

Attend a Session

We hold regular events for prospective students and parents

Attend a Session

prospective students and parents

Study at PES

Study at PES

Contact Us

Read our FAQs or contact us:

Ring Road Campus /

Electronic City Campus:

080-10-297297

Hanumanthanagar Campus:

+91 80 22429391

Contact Us

Read our FAQs or contact us:

Ring Road Campus /

Electronic City Campus:

080-10-297297

Hanumanthanagar Campus:

+91 80 22429391

You may also be interested in

Giving to PES

The support extended by patrons like you, has been the primary reason for the substantial growth of our institution. Your contribution would greatly assist in making your PES a world-class institution.

Staying in Touch

Join Alumni Network: The PES website supports the alumni network. All a student needs to do is create an account and you can start connecting with our Alumni to access a range of opportunities and benefits.

Discovering our Newsletters

The Student Newsletter is your guide to what’s happening on campus and in the student community. Find out about PES events, leadership, career and the amazing achievements of your fellow PESU students!